SMARTSCORE SIMULATOR

1. The SmartScore Simulator allows you to build and also correct your credit data testing

to gain valuable points. The SmartScore Simulator will also show you how many

points you may lose by making the wrong decisions.

2. Modify one or more fields of data. Click Run to simulate your results. Then follow the

Recommendations to maximize credit scores.

3. The information included in the simulator are as follows:

• Creditor

• Account #

• Date Opened

• Date Reported

• Credit Limit

• Responsibility (Individual, Joint, Authorized User)

• Balance

• Past Due

• Credit Utilization (in red or green)

• Lates (Month and Year)

• Current Status

• Point Deductions

• Account Information Disputed by Customer (comments)

• The date in which the account is scheduled to be removed from the credit report

4. In the example below, the fields outlined in red indicate the changes made. The

results are shown on the right which include the potential score change, how much it

will cost the borrower, and the best estimated day of the month to have their credit

pulled.

• BARCLAYS CR US: Credit Limit was changed from 2900 to 5000. The Balance was

changed from 1100 to 800.

• CHASE: Credit Limit was changed from 0 to 3000.

• CREDITONEBNK: Status was changed to DELETE.

5. To reset the values in the fields outlined in red, click on Reset Values.

6. To add a new account, click on Add Account.

7. Choose the Account Type (Credit Card, Installment, Auto, Mortgage), Responsibility

(Individual and Auth User), and enter the Credit Limit and Initial Balance. You can add

up to three new accounts. Once complete, click Submit Account. After returning to the

SmartScore Simulator page, click Run to simulate how adding these accounts will

impact the scores.

8. The results will appear on the right, showing the potential score change and the

associated cost for the borrower.

9. To drop this account from the simulator, simply click on the red ‘x’ to the left of the

account.

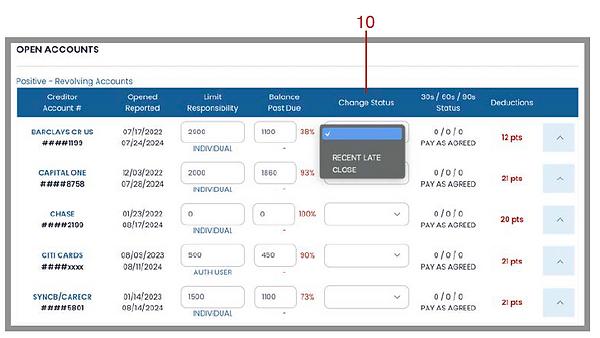

10. To change the status of an account, click on the Change Status dropdown.

The Change Status feature allows you to simulate the impact of modifying an

account’s standing on a credit report. This tool is particularly useful when assessing

how different actions—like removing a late payment or closing an account—might

affect a credit score. It’s a key feature of the SmartScore Simulator that helps users

test credit scenarios and make informed decisions. Below are the available options

along with brief explanations of each action.

OPEN ACCOUNTS

a. For Positive - Revolving Accounts, you may select: Recent Late or Close.

i. Recent Late: A newly reported 30-day past due on an open revolving account.

ii. Close: Simulates the account being closed.

b. For Negative - Revolving Accounts, you may select: Pay As Agreed or Delete.

i. Pay As Agreed: Updates the open revolving account to show current, on-time

payments.

ii. Delete: Simulates the account being removed from the credit report.

c. For Positive - Auto Accounts, you may select: Recent Late or Close.

i. Recent Late: A newly reported 30-day past due on an open auto account.

ii. Close: Simulates the account being closed.

d. For Authorized User Account, you may select Terminate Auth User.

i. Terminate Auth User: Simulates the removal of the borrower as an authorized

user from the open account.

CLOSED ACCOUNTS

e. For Positive - Revolving Accounts, you may select: Recent Late.

i. Recent Late: A newly reported 30-day past due on a closed revolving account.

f. For Collection Accounts, you may select: Delete.

i. Delete: Simulates the account being removed from the credit report.

11. To delete the dispute comment, open the account by clicking on the blue toggle icon

to the right of the account, and click on the checkbox next to the comment. Then hit

Run to simulate.

12. Potential Score Change - When the SmartScore Simulator is ran, it generates the

Potential Score Change. This includes showing how many points the credit score

could change, an estimate of any related costs, and the best day to have the credit

pulled after following the recommended actions. These results help users understand

the steps to take and the ideal timing for optimal credit outcomes.

13. Potential Rescore Change - The Potential Rescore Change is the estimated result

shown after running a Rapid Rescore for the borrower. It provides insights into how

many points the credit score could change and any related costs. This helps users

plan their steps for the best possible credit outcomes. Disclaimer: The impact of

inquiries from Rapid Rescore may vary. Actual score changes depend on creditor

reporting and timing.

14. PDF Download for Results - After using the simulator, you have the option to

download the results in a professional PDF format. This report can be conveniently

shared with the borrower via email or printed for their review, ensuring clear

communication and actionable insights.